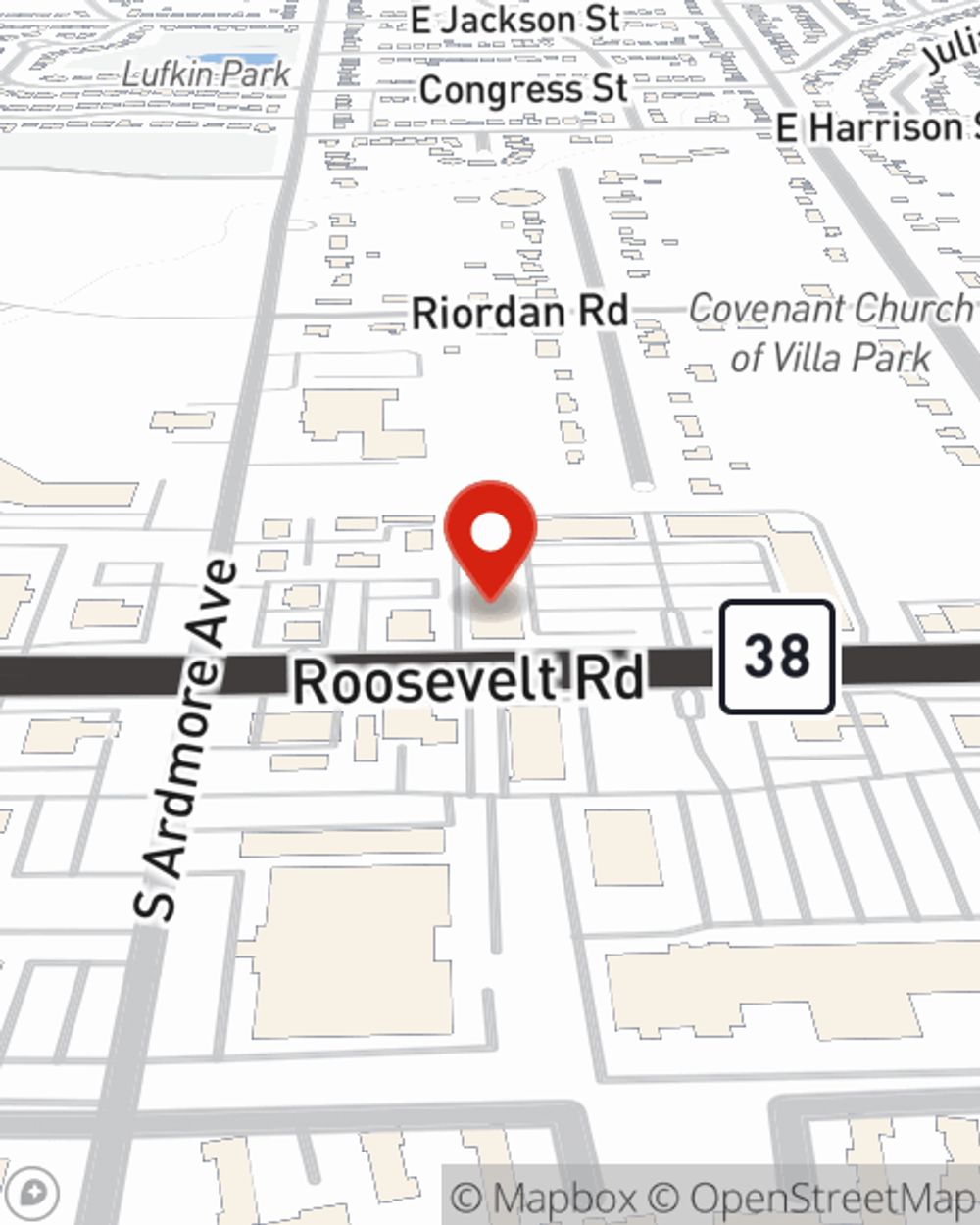

Auto Insurance in and around Villa Park

Looking for great auto insurance in Villa Park?

Let's hit the road, wisely

Would you like to create a personalized auto quote?

Here When The Unexpected Arrives

Whether it's a hybrid or a sedan, your vehicle could need excellent coverage for the necessary work it contributes to keep you moving. And especially when the unanticipated happens, it can be important to have the right insurance for this significant factor of your daily living.

Looking for great auto insurance in Villa Park?

Let's hit the road, wisely

Great Coverage For A Variety Of Vehicles

The right savings may look different for everyone, but the provider can be the same. From emergency road service coverage and uninsured motor vehicle coverage to savings like Drive Safe & Save™ and an anti-theft discount, State Farm really shifts these options into gear.

Villa Park drivers, are you ready to find out what the insurer of over 44 million auto policies in the United States can do for you? Get in touch with State Farm Agent Dan De La Cruz today.

Have More Questions About Auto Insurance?

Call Dan at (630) 516-0092 or visit our FAQ page.

Simple Insights®

Choosing a motorcycle helmet

Choosing a motorcycle helmet

Motorcycle helmets are important for everyday riding, as well as helping to protect your head in case of a crash. Learn more about selecting the right helmet.

What happens if I am not at fault in a car accident?

What happens if I am not at fault in a car accident?

Learn how to file an insurance claim after a not at fault car accident. Understand third-party vs first-party claims, deductibles and subrogation.

Dan De La Cruz

State Farm® Insurance AgentSimple Insights®

Choosing a motorcycle helmet

Choosing a motorcycle helmet

Motorcycle helmets are important for everyday riding, as well as helping to protect your head in case of a crash. Learn more about selecting the right helmet.

What happens if I am not at fault in a car accident?

What happens if I am not at fault in a car accident?

Learn how to file an insurance claim after a not at fault car accident. Understand third-party vs first-party claims, deductibles and subrogation.